You can listen to this conversation on Spotify, Apple, anchor (and via RSS) or find a full transcript at Compound.

“This is the nature of what we do. It's the intersection of business and people and psychology and sociology and numbers. There's a lot of stuff that's always going on that makes sure you never have the game beat, never.”

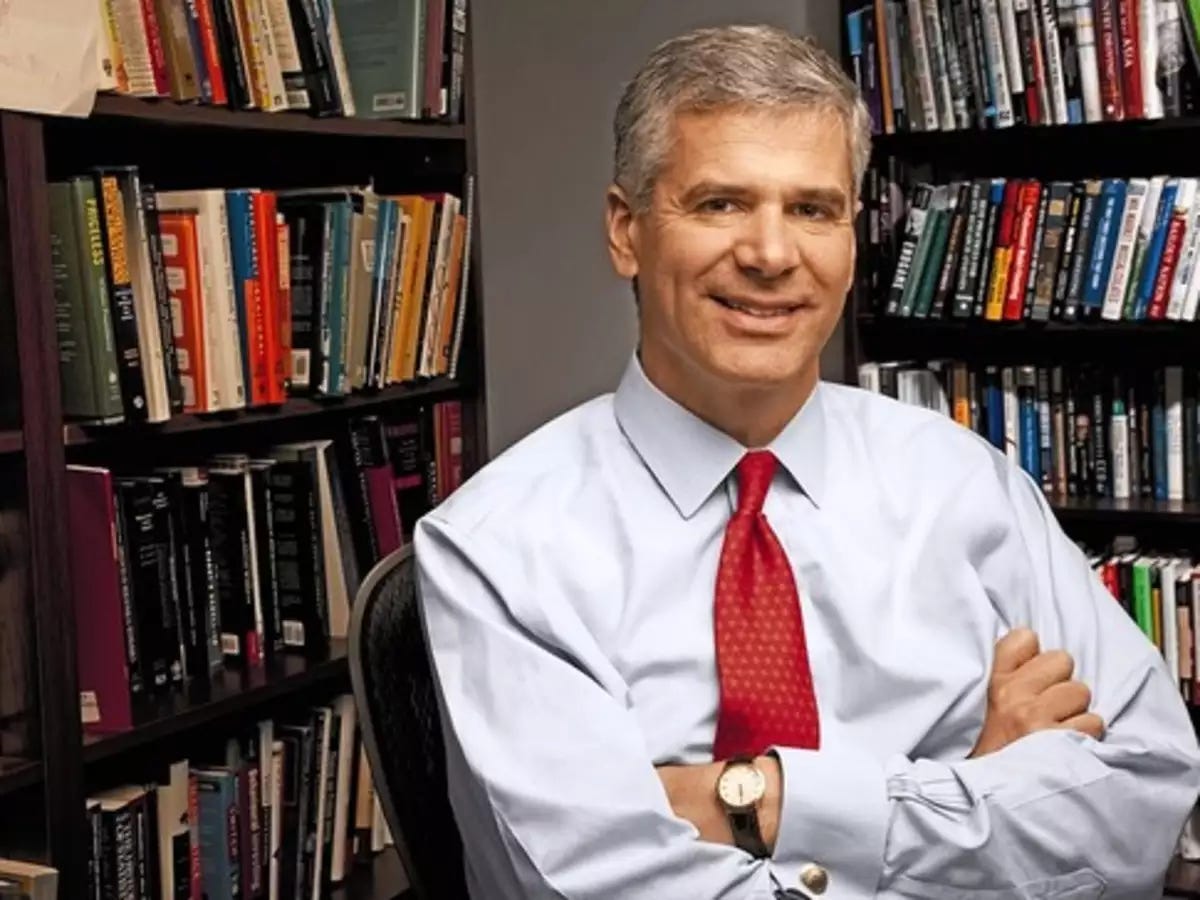

This past June I had the opportunity to interview Michael Mauboussin. I tremendously enjoyed this conversation and I believe it captures Michael’s deep curiosity and passion about investing, business, the research process, and being a multi-disciplinary learner.

At the time I published a full transcript at Compound. I am happy that I can now share the audio version.

I assume many of you are familiar with his work. For an easy introduction check out this 2021 profile. Another excellent piece is his Reflections on the Ten Attributes of Great Investors which incorporates many of his key frameworks. And be sure to check out his new website with a library of his collected writings.

If you’re looking for an all-in-one solution to manage your personal finances, Compound can help. The firm can help diversify concentrated stock positions, optimize company equity, plan asset allocation, and more. You can sign up for access here.

For more information, please check out further disclosures here.

“Most investors act as if their task is to figure out a stock’s value and then to compare that value to the price. Our approach reverses this mindset. We start with the only thing we know for sure — the price — and then assess what has to happen to realize an attractive return. … The most important question in investing is what is discounted, or put slightly differently, what are the expectations embedded in the valuation?”

The below are some of my favorite highlights.

You can listen to the conversation on Spotify, Apple, at anchor, and via RSS or find a full transcript at Compound.

Druckenmiller, Soros, and position sizing

“When you observe very successful people over very long periods of time in these probabilistic fields, they tend to have certain attributes that are worth all of us paying attention to.”

“Here we have George Soros and Stanley Druckenmiller, two legendary investors, who say that [position sizing] is the main thing that drives their returns and results over a long period of time. Whereas we look at the real world, we find that most people don't create a lot of value from sizing and it's all security selection. The question is can we bring those things together to some degree?”

Analysts and portfolio managers:

“A very good portfolio manager will be able to focus on the two or three issues that matter most for a particular company. And they're very good at identifying those and honing in on those.”

“There was a letter from Seth Klarman at Baupost to his shareholders. He said, we aspire to the idea that if you lifted the roof off our organization and peered in and saw our investors operating, that they would be doing precisely what you thought they would be doing, given what we've said, we're going to do. It's this idea of congruence.”

Holding Amazon for two decades

“I first learned about this company from Bill Gurley who at the time was part of the underwriting team at Deutsche Bank who did the IPO. Bill just said, you should meet these guys because the way they think about things, even though this is a completely nascent industry doing, completely different stuff, the language they're using is the language you're going to be familiar with.

“In the late 1990s, I met Jeff Bezos and Joy Covy, the CFO. … Joy would just say to me, we’re big fans of Warren Buffett and Charlie Munger. We think about return on capital. We think long term. We're making investments that appear to be bad, but when you pencil out the numbers, we think we're going to generate really attractive returns. I bought into that.”

“I was very influenced by a wonderful book by Carlota Perez that came out probably in the early 2000s where she talks about the interplay between technological revolutions and financial capital, one of the points she made was, it's often the case that the hard work happened after the financial bust.”

On feedback, learning, and teams of superforecaster (aka investors)

“In every domain elite performers tend to practice. Every sports team practices, every musician practices, every comedian practices. What is practice in investment management? How much time should we be allocating to that?”

“The investment management industry is an industry that draws a lot of really smart people. It's a very competitive, interesting field. It's remarkable in the sense that feedback is very difficult to attain. In the long run it's portfolio performance and so on. But in the short run it's very, very difficult to do.”

“There's a distinction between intelligence quotient and rationality quotient, which is the ability to make good decisions. Along with some of his colleagues he developed a specific test to measure rationality. And if you look at the subcomponents of that test, it seems really consistent with what we would care about as investors. “

“When I say elite teams, or when Tetlock talked about elite teams, this elite teams in superforecasting. So these are the best of the forecasters working together. There are three important things. How big should it be? How do we compose the team? The third and final piece is how you manage the group. And this is usually where the mistakes happen.”

Lessons for operators from his book Expectations Investing.

“Executives of public companies in particular should absolutely understand the expectations priced into their stock. The first reason is that if they believe something that the market doesn't seem to be pricing in, they have a communication opportunity.”

“Very few executives really understand how capital markets work. This is almost like our analyst portfolio manager conversation. When you get to that seat, all of a sudden you have responsibilities and skills that become important that you may not have ever dealt with before.”

“Understanding what has to happen for today's price to make sense is just such a fundamentally attractive proposition. And then evaluating whether you think that those growth rates in sales and profit margins and capital intensity and return on in capital that's implied, whether those things are plausible or not, it just makes enormous sense as an approach.”

Thank you, Michael!

“To be a great teacher, an effective teacher, it's about being a great student, a great learner yourself. I think that comes through if you're doing it well.”

🎙Audio Repost: Reflections on the Investing Process with Michael Mauboussin