Bill Miller: An Investor's Evolution (Part I)

“The conventional wisdom about value investing was wrong.” “We are interested in the underlying economic reality of the business and not how they report."

This is the first part of my Bill Miller profile. Check out part II.

In 2001, Bill Miller was under fire. It was a spot the value investor, famous for his market-beating streak, wasn’t used to.

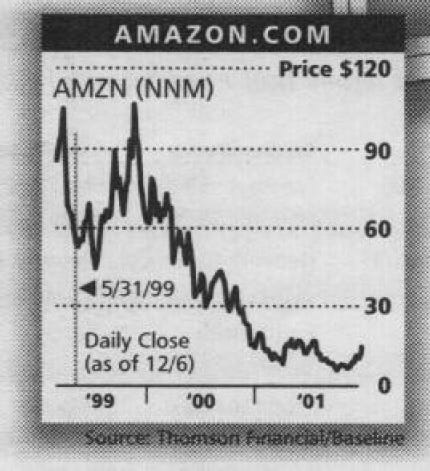

Miller had invested in Amazon in 1999 and shared his conviction publicly in Barron’s. Meanwhile, the magazine had called Bezos “just another middleman” and ran an infamous cover story headlined “Amazon.bomb.” Two years later after Miller’s investment, Amazon stock had cratered to $5.50 from a peak of $107. Had Miller mindlessly thrown his value-investing principles overboard and turned into the last buyer to rush into the dot-com bubble?

From today’s perspective, it’s hard to imagine that the trade of a lifetime, buying more Amazon stock in the middle of the dot-com bust, was controversial and difficult. Miller admitted “we were clearly wrong in buying when we did,” and averaged down. He eventually shifted from Amazon stock to the convertible bonds (which also allowed him to realize a tax loss). He remained steadfast in his belief in the company’s future. “Most people try to maximize the number of times they’re right,” he said. “The real question is how much you make when you’re right.”

Navigating change is difficult, especially in investing where tinkering with your process can look like “style drift” and chasing the latest fashion. I struggle with this myself as it’s difficult to distinguish lasting change from fads.

WCM’s Paul Black wrote that the investment industry "too often worships at the altar of process. Where else are you penalized for growing your knowledge base and making necessary improvements?” Investing in Amazon and other technology companies required for Miller to abandon dogma and endure criticism from friends. It required an independent and open mind as well as conviction to depart from the accepted wisdom or, in this case, the generally accepted accounting principles.

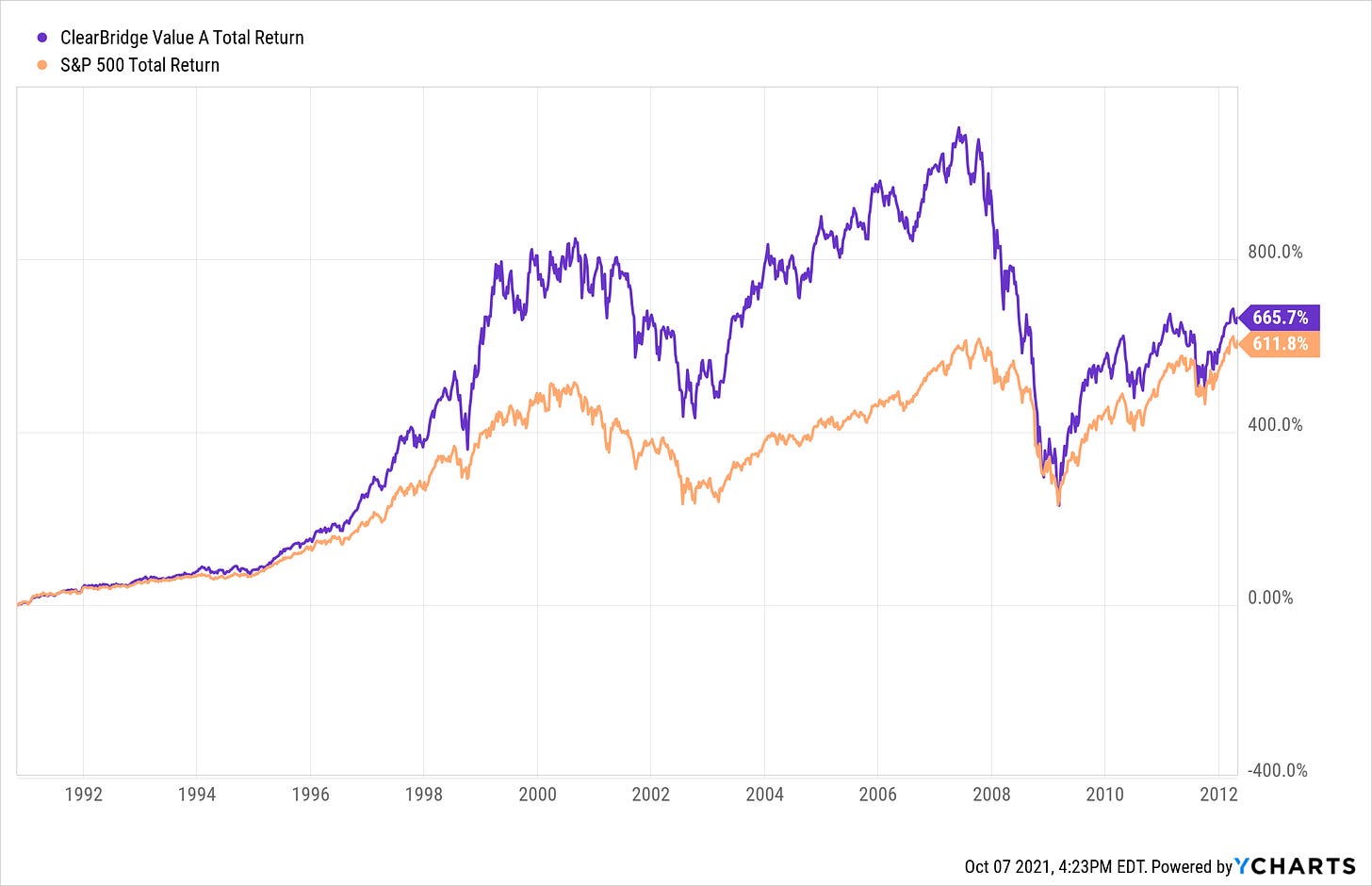

Miller’s embrace of new ideas was the first part of his fascinating journey. The second came when, after fifteen years of beating the market, he invested in imploding housing and financial stocks during the subprime crisis and his career seemed to come to an end. This mistake overshadowed decades of hard work and success.

By the time I moved to the U.S. in 2010, Miller’s reputation had suffered. Movies like The Big Short presented him as a caricature of the investment establishment. However, I found his letters, starting in 1995, to be an invaluable education. I was able to step into his shoes and follow along as he solved the market’s puzzles by incorporating ideas from a variety of disciplines, including his education in philosophy and involvement with the scientists of the Santa Fe Institute who taught him frameworks crucial to understanding the value of novel technology companies.

Miller made a roaring comeback. His journey holds lessons about change: adapting to it, misunderstanding it, and coming back after being buried by it.

In this first of two parts, I’ll focus on Miller’s journey from getting started as an investor to the top of the dotcom bubble.

All quotes in this piece are from Bill Miller, unless otherwise noted.

The case for quality

“We were fortunate that the 1990s were similar to the 1980s. Value investing beat growth in the early 1990s, as it did in the early 1980s. After the Fed began tightening in both decades, value investors who relied on accounting metrics alone, and failed to take into account the drivers to business value, languished.”