Hello everyone,

This is the third part of my series on Stanley Druckenmiller (part 1, part 2). This piece is about 1987, a period that illustrated his legendary open-mindedness, speed, and aggressive trading style. Druckenmiller’s agility stood in sharp contrast to George Soros who struggled to navigate the crash and committed what Sebastian Mallaby called “perhaps the worst call of his career.”

On Friday, Oct. 16, 1987, Stanley Druckenmiller walked over to the office of George Soros, his new investing idol. Druckenmiller had started the year long stocks and by early summer he started shorting.

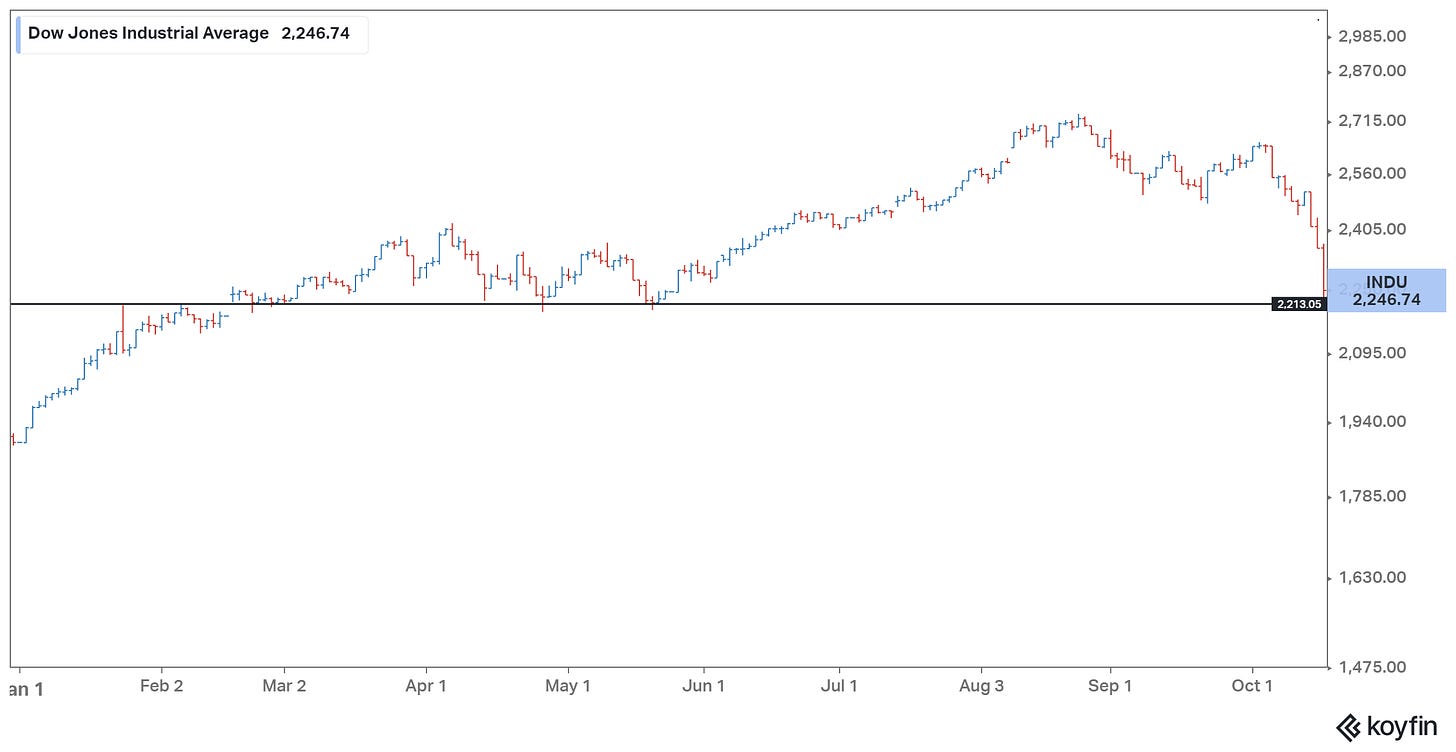

After a peak in August, the market started to decline. Now, he believed, it had found strong support at around 2,200. That Friday, Druckenmiller switched to being long.

Dow Jones in 1987:

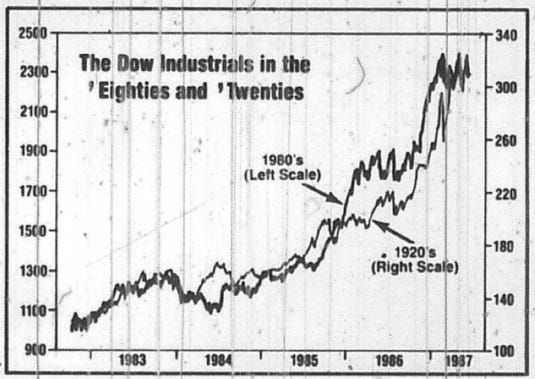

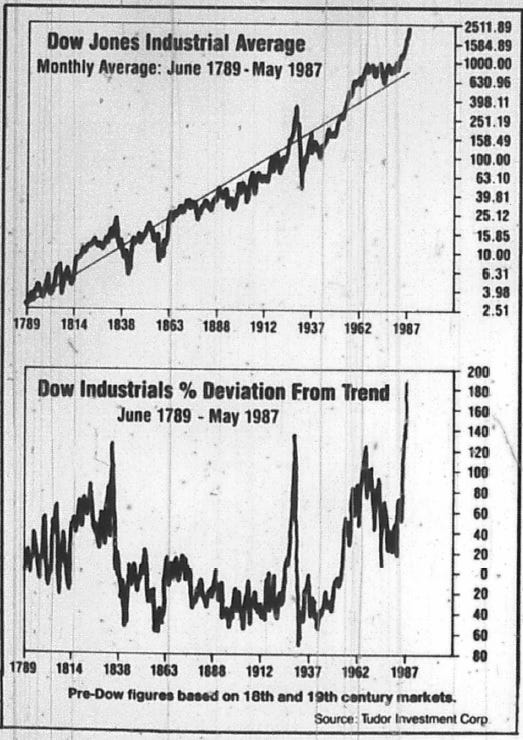

Soros welcomed the young trader and showed him a series of charts he had obtained from Paul Tudor Jones. One of them compared the market of the 1980s with that of the 1920s. Another showed how far the index had deviated from its historical trend—a condition that had historically resolved itself in crashes.

(See my write-up of Paul Tudor Jones for the backstory.)

Druckenmiller was stunned:

“The study demonstrated the historical tendency for the stock market to accelerate on the downside whenever an upward-sloping parabolic curve had been broken—as had recently occurred. The analysis also illustrated the extremely close correlation in the price action between the 1987 stock market and the 1929 stock market, with the implicit conclusion that we were now at the brink of a collapse.”

Suddenly, he felt like he had made a grave mistake. Not only that: he must have felt embarrassed that his would-be mentor was the one to point out his error.

“I was sick to my stomach when I went home that evening. I realized that I had blown it and that the market was about to crash.”

For a glimpse at Wall Street on the eve of the crash, check out Wall Street Week with Marty Zweig that Friday (courtesy of a channel called crashof1987) You can see Zweig’s prediction around 6:45-8:30.

Before the Crash - Wall Street Week October 16, 1987:

Meeting the alchemist

Druckenmiller had already been a trader across asset classes by the time he met Soros in 1987. Sebastian Mallaby wrote in More Money Than God:

“His forte lay in combining different disciplines. To a solid sense of equities he added a strong feel for currencies and interest rates, picked up from the PhD course in economics that he had begun before deciding that the ivory tower was not to his liking. As one admiring colleague put it, Druckenmiller understood the stock market better than economists and understood economics better than the stock pickers; it was a profitable mixture. By following equities and speaking regularly with company executives, Druckenmiller got advance warning of economic trends, which informed his view of bonds and currencies. By following economies, he got advance warning of the climate for stocks. If a currency was heading downward, export stocks would be a buy. If interest rates were rising, it was time to short real-estate developers.”

Druckenmiller was looking for two diversification from stocks and markets that were volatile enough for him to earn significant profits. “By the early to mid-80s, commodities were having dramatic moves,” he reflected in his speech at the Lost Tree Club. “Currencies were having big moves, bonds were having big moves.”

“I’d rather have a menu of assets to choose from to make my big bets and particularly since a lot of these assets go up when equities go down.”

“I'm not in the business of making a fortune if something goes from 10 basis points to 20 basis points. That’s not something I’m going to make a big bet on.”

In 1987, Soros published The Alchemy of Finance, a milestone for traders blending fundamental and technical approaches into the evolving style of global macro. Druckenmiller immediately recognized that he was developing a similar style as Soros and reached out to the master alchemist.

“When I read The Alchemy of Finance, I understood very quickly that he was already employing an advanced version of the philosophy I was developing in my fund.”

Soros was actively looking for a successor as portfolio manager and over lunch tried tried to hire Druckenmiller. But Druckenmiller declined. He was not ready yet.