📚 Studying Predators

"The greatest successes are explained by the establishment of clever arrangements for the reduction of risks."

“The things we admire in men, kindness and generosity, openness, honesty, understanding and feeling are the concomitants of failure in our system. All those traits we detest, sharpness, greed, acquisitiveness, meanness, egotism and self-interest are the traits of success. And while men admire the quality of the first, they love the produce of the second.” John Steinbeck

Sometimes I struggle with the stories I research. Profiles of successful investors and entrepreneurs can be inspirational and chock-full of valuable lessons. But sometimes questionable and obnoxious behavior lurks behind the polished origin stories. Rags-to-riches fantasies can camouflage apex predators.

Why even profile controversial individuals? Corporate raiders were quick to denounce overpaid management teams and inefficient, overstaffed corporations. But once in control, many didn’t hesitate to enjoy lavish pay and perks. Or take Marc Rich, an upcoming profile of mine, who came to the US as a refugee during WWII and built a commodity trading empire. In his quest for profits he engaged in illegal trading schemes and continued to do business with sanctioned Iran. He escaped prosecution by Rudy Giuliani and spent his life in exile in Switzerland.

These stories resemble Necker Cubes, ambiguous drawings that reveal a different shape depending on which part you focus on. Inspiration, lessons, cautionary tales, and sometimes deplorable or even illegal behavior — they can all part of the same story.

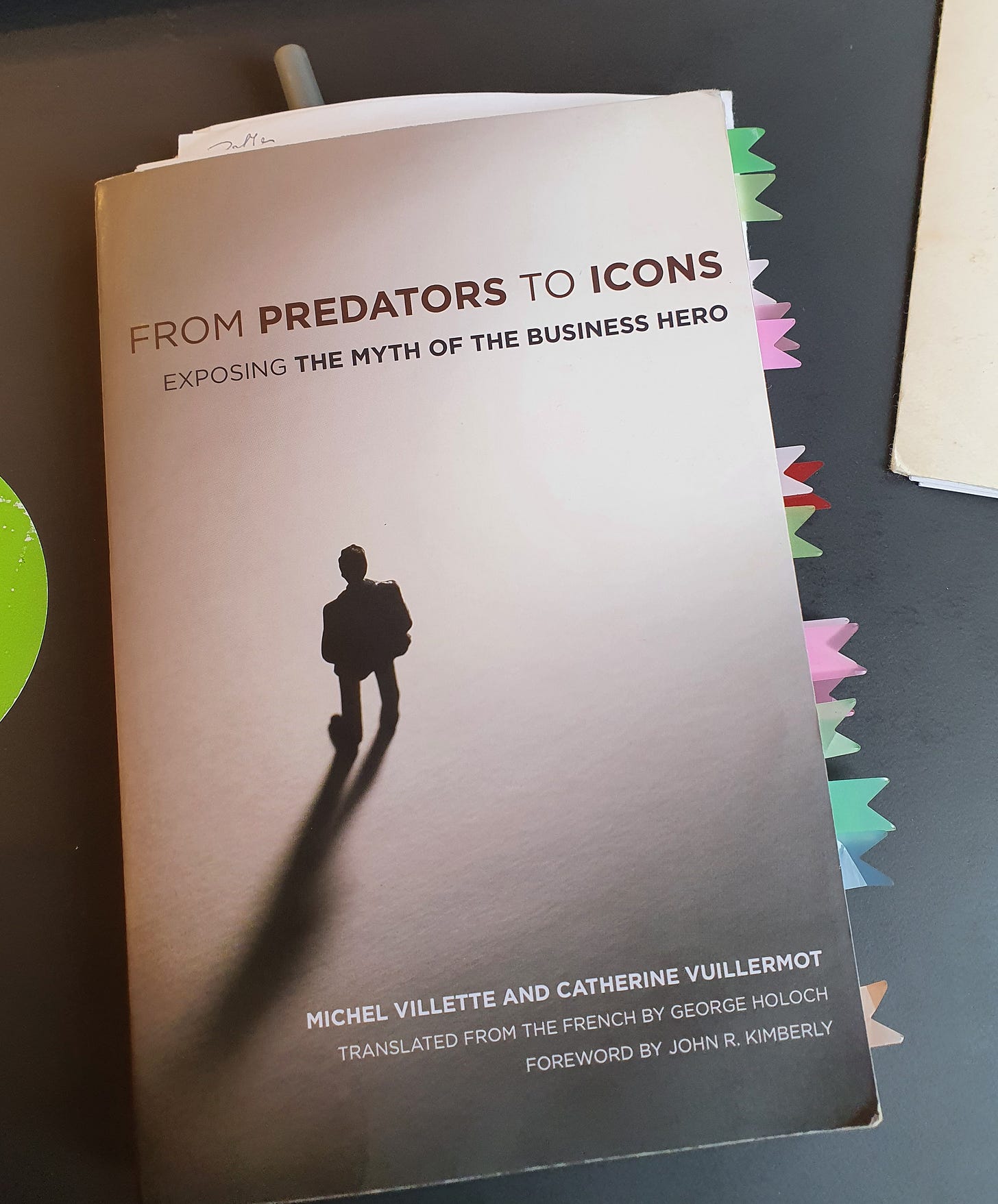

Two French professors wrote about the ambiguity of business fortunes in their book From Predators to Icons. It is a frontal assault on the hero worship of self-made businessmen. They looked for patterns in a sample of 32 businessmen (no women, sadly) and found that fortunes were built on “predatory behavior.” This included exploiting market imperfections or asymmetries, acquiring misunderstood assets, taking advantage of motivated sellers, and using political connections or loopholes in regulatory frameworks. In other words: Self-made tycoons were ruthless competitors who used any advantage they could find.

The authors focused on the early stages of each career, what they called the moment of “intense accumulation of capital.” Like companies, people transition from startup to blue chip, from pirate to captain of the navy. Peter Thiel says a startup has to move from “zero to one.” In the same way, people have to learn how to create and capture wealth before compounding and competing at scale. Both phases can hold lessons. But while the second phase typically happens in the public eye, with financials and deals scrutinized in the open, the initial transition happens under the radar.