Hi everyone.

Another week has gone by and the war in Ukraine continues. It feels self-indulgent to even write about investing from the comfort of a safe and warm home. Last weekend, I went to Washington Square Park to a demonstration. It wasn’t as big a crowd as I had expected. Some Ukrainian friends went to Washington DC. Many more are active on Instagram, venting their anger, sharing their fears, and raising donations.

As I experience the war through the “reality tunnel” of social media, I constantly have to remind myself that that the sheer quantity of attention-grabbing information is not equivalent to getting a high quality picture. It’s Kahneman’s “what you see is all there is” bias (or availability heuristic?). If my Twitter feed is filled with follies and fumbles by the Russian military (like busted tires, columns stuck in the mud or out of fuel, abandoned vehicles being lit on fire, even the paratroopers not living up to expectations), and yet they’re advancing, then I’m probably getting a biased picture.

We’re witnessing what it’s like to disconnect a modern economy from the rest of the world. Garry Kasparov called it the “technological stone age.” Axios had a list of companies withdrawing and the number of global brands participating seems unprecedented? You can find anecdotal evidence of the impact all over Twitter (helpful thread). For example: without Apple Pay and Google Pay you need cash and paper tickets.

Marc Rubinstein wrote about the ongoing financial warfare: “as a means of inflicting economic pain, targeting the banking system is a good place to aim. The world learned that accidentally during the global financial crisis, and many European countries learned it again several years later.” With payment flows disconnected and trading on Moscow’s exchange halted, Russian stocks crashed in London. There was an offer for Sberbank at stock at literally $0.00. Though I started getting confused when I saw the steep sell-off in Russian energy names.

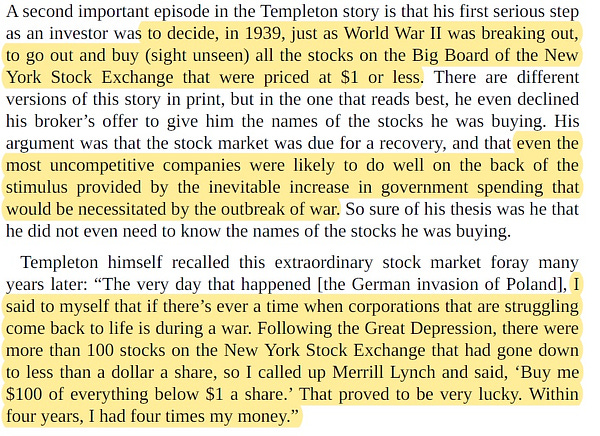

I was also astonished to discover that I own some 150 shares of Yandex in my personal account. As I looked at the stock, its price frozen, I faintly remembered thoughts like “oh, the Google of Russia, probably oversold, and surely Putin wouldn’t risk his economy on some absurd 20th century invasion.” It’s the kind of braindead trade - no, strike that, mindless gamble - that I unfortunately do from time to time. It was also a mistake that my mind apparently quickly dumped into the memory hole to protect my self image.. Talk about someone studying experts only to act like a complete amateur. It is my hope that by writing about it - by creating a kind of public shaming - I will finally rid myself of this behavior. And I will let Peter Lynch remind us all why compulsive bottom-fishing is treacherous:

I was still confused about the price action in Russian stocks and the Russian ETF, RSX, which seemed to trade at a big premium to its NAV. I turned to Dave Nadig (Chief Investment Officer and Director of Research at ETF Trends) who has written about exactly this issue (and who also appeared on Infinite Loops).

I hope you enjoy our brief conversation around this topic. For more context and charts check out Dave’s writing and Twitter feed (Eric Balchunas is also good and of course Matt Levine has written about the issue as well).

A few key takeaways:

There’s precedent in an ETF’s liquid underlying assets turning illiquid (or a permanent liquidity mismatch such as with junk bonds). The local stock exchange being closed is merely a special case. However, there are few precedents for the uncertainty around Russia given the small number of modern pariah states - think Iran, Cuba, North Korea.

Stock prices collapsing has a lot to do with the uncertainty around the status of the depositary receipts traded abroad. Gazprom’s assets are valuable. It’s equity is probably valuable. But depositary receipts owned by foreigners may or may not be valuable in the future. As Mark Gutman put it: “The value of a piece of paper that gives you rights to nothing is zero.”

With the underlying market closed, the ETF becomes a proxy for price discovery. But once the creation of new shares is suspended, it becomes disconnected from the value of the underlying, essentially like a close-end fund that can trade at a premium or discount to NAV.

The removal of Russian shares from emerging market indices (and therefore ETFs) at a price “at a price that is effectively zero” was particularly puzzling to me and Dave walked me through the process. Personally, I think these have at least some option value and it’s going to be interesting to see if at some point in the future we’ll hear about a creative trade.

Meanwhile, Russian traders are left with what the Germans call Galgenhumor or gallows humor:

“Dear stock market, you were close to us, you were interesting, rest in peace dear comrade.”

Personally, I’m encouraged to see that the West is getting serious chasing down the oligarchs. Even Germany seized a $600 million yacht. (Although I’m not quite sure about the legal backdrop of seizing private property of people loosely affiliated with a hostile regime? If someone has a good background piece, I’d be interested). My hope is that pressure on Russia’s elite could become Putin’s undoing (and I could really use more hope when some people are talking about a 10 percent chance of the world ending).

Still, it’s worth considering the long-term implications and downside of economic warfare. Russia is going to move closer to China (worst case: a nuclear-armed vassal state?). The world will experience more sustained inflation in energy and food. And it saddens me to think that there are likely a great many people in Russia who don’t support the war but can’t risk jail or beatings to protest. Who will be fed propaganda and be censored in their speech. Feelings of hostility and bitterness among average people will get entrenched as the hearts harden.

Men in my family fought and died in the German armed forces during WW2. My surviving grandparents, now in their late 80s, were children when the war ended and vividly remember the bombings, artillery shelling, and tense final days of fighting and surrender. These memories never leave. It’s haunting to think that new ones much like them are being created as I write this. I hope this will be the last time I write about the war, but I doubt it.

Stanley Druckenmiller interview with The Hustle in 2021:

On the biggest risks to the equity market:

Stanley Druckenmiller: Without a doubt: inflation strong enough that the Fed responds to it. No doubt about it. This bubble has gone long enough and it’s extended enough that the minute they start tightening, the equity market should go down a lot.

Particularly with so much of the cap weighted in growth stocks, which would be hit the worst. And our central case is that inflation occurs, but we’re open-minded to something like ‘07-’08 when you never really got to the inflation because the bubble popped. So, inflation never got to the manifestation stage.

This week

Letters: Dan McMurtrie on regime change

War Trades

Pod: Eric Mandelblatt of Soroban

Twitter Snacks: Greenblatt, Buffett, Steinberg, Paul Tudor Jones, James Clear

Disclaimer: I write for entertainment purposes only. This is not investment advice. I am are not your fiduciary or advisor. Do your own work and seek your own financial, tax, and legal advice before making any investment decisions.

💡You could be sponsoring posts like this one if you’re looking to reach 8,000+ thoughtful subscribers and many more readers on Twitter.😏

Letters: Dan McMurtrie of Tyro Capital on regime change

I was planning to highlight the backlog of letters and write-ups this week. In the interest of time I’m going to excerpt just one. Also, be sure to check Dan’s recent podcast.

“After seeing government responses to COVID in 2020, markets began to price in (1) unlimited and (2) effective support from both (1) monetary and (2) fiscal policy. Astronomically high multiples could be mathematically justified under those assumptions, particularly given the demonstrated willingness to directly fund consumer spending under adverse circumstances. … But with inflation rearing its head, those things are off the table, and the market has to price in a massive, top-down regime shift so long as that is the case.

Regime shifts are rarely smooth, as market participants (many of whom are leveraged) are forced to rotate their portfolios and recalibrate to different market and policy conditions.

This is difficult psychologically and mechanically – when is the last time a current portfolio manager had to deal with a serious bout of inflation?

The lack of policy optionality as well as private sector response capability – both of which were able to handle severe risks during 2020 – means the potential severity of both known and unknown risks in the future is amplified. Thus, there is relatively less margin for error in the world right now, and the result is a repricing of assets to reflect that. We think this makes sense. No one wants to be punched in the face, but it is a far more serious matter if your blood cannot clot.”

War Trades

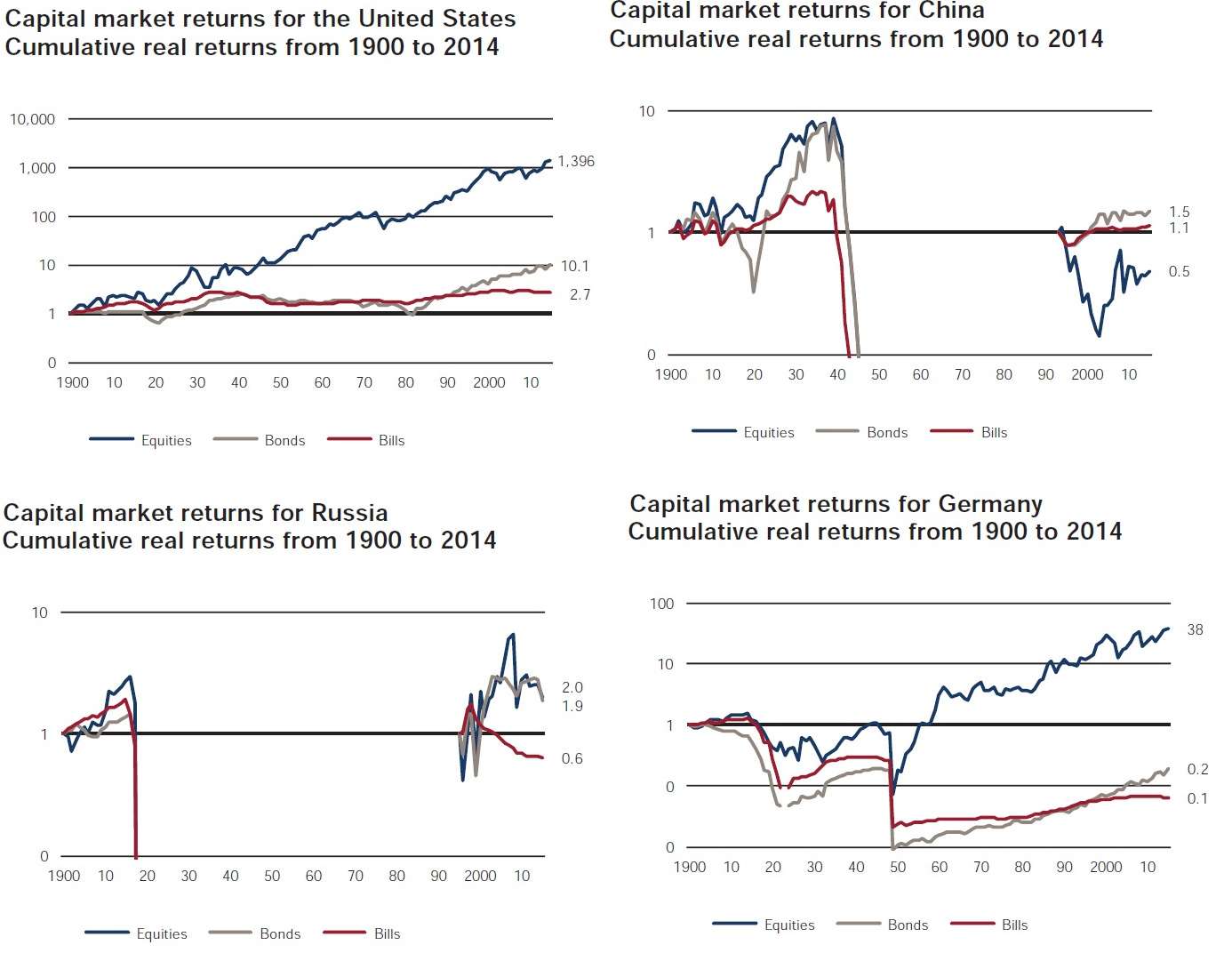

We’re trained to think of the stock market as long-term wealth compounding machine. All we have to do is endure an occasional bear market. But war and regime change can destroy an enormous amount of wealth. Source: Credit Suisse Global Investment Returns Yearbook 2015

War and political upheaval also occasionally lead to unique trades. I collected a few examples in this thread, from Templeton to Baruch, Keynes, and Rothschild. If you know of other examples, would love a comment or email/DM.

Pod: Eric Mandelblatt of Soroban

On Invest Like the Best (my notes on Twitter)

This was recorded before the invasion of Ukraine and the spikes in many commodities and related stocks. It’s a very engaging deep dive that connects the big theme of decarbonization with existing structural imbalances and an analysis (or pitch) of specific businesses - US railroads and Alcoa. Could this episode simultaneously be an indicator of a long-term opportunity and a short-term signal for caution? We’re a long way from late 2020, when investors didn’t want to touch energy and materials with a ten foot pole.

“The royalty company sitting on top of this resurgence of industrial production ... the picks and shovels way to get leverage is the US railroads. … What are the businesses we'd be comfortable buying a 100-year bond from? Because it's almost the definition of incumbency, barriers to entry longevity. The railroads are my number one. They have 100-year bonds that yield 4% today.”

“Almost every market we're looking at is in deep structural undersupply. In some commodities we're seeing spiking demand. It's a backdrop I've never witnessed during my career.”

Twitter Snacks

Buffett in 2010 on Pricing Power (Financial Crisis Inquiry Commission)

“The single-most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by a tenth of a cent, then you’ve got a terrible business. I’ve been in both, and I know the difference.”

The example was Moody’s:

“They have done very well in terms of huge returns on tangible assets, almost infinite. And they have –- they have grown along with the business that generally the capital markets became more active and all that. So in the end –- and then raised prices –- we’re both — we’re a customer of Moody’s, too, so I see this from both sides, and -– we’re an unwilling customer, but we’re a customer nevertheless. And what I see as a customer is reflected in what’s happened in their financial record.”

Interestingly, when asked about management he punted, explaining that outstanding management was not necessary to make this a great investment.

“I knew nothing about the management of Moody’s. The –- I’ve also said many times in reports and elsewhere that when a management with reputation for brilliance gets hooked up with a business with a reputation for bad economics, it’s the reputation of the business that remains intact.

If you’ve got a good enough business, if you have a monopoly newspaper, if you have a network television station — I’m talking of the past — you know, your idiot nephew could run it. And if you’ve got a really good business, it doesn’t make any difference. I mean, it makes some difference maybe in capital allocation or something of the sort, but the extraordinary business does not require good management.”

But notice that he quickly corrected himself: “I’m talking of the past.”

Speaking of Buffett: thread with lessons from 50 years of shareholder letters.

How to navigate big regime shifts like Paul Tudor Jones? “Don’t be a hero. Don’t have an ego.”

Remember your competition (via Ian Cassel):

This one hit home. I have an issue with clutter and letting go. I look around and there are too many stacks of books, piles of notes, and long lists of what I want to do. It becomes a distraction from being fully present and focusing on one important thing right now.

“Look around your environment. Rather than seeing items as objects, see them as magnets for your attention. Each object gently pulls a certain amount of your attention toward it. Whenever you discard something, the tug of that object is released. You get some attention back.”

Enjoyed this piece? Please let me know by hitting the ❤ button. It makes my day to see whether my readers like the content (it really does!) Thank you!

If you enjoy my work, please consider sharing it with friends who might be interested.🙏

Weekly Workshop: Dave Nadig on Russian Stocks, Regime Change, War Trades, Mandelblatt, Pricing Power, Industrials, Twitter Snacks